Reviving the American Economy: The Rise of New Factories Buying Build

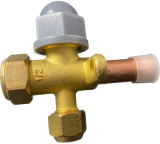

Image Source: FreeImages

## Introduction to the revival of the American economy

The American economy has experienced its fair share of ups and downs over the years. From the industrial revolution to the dot-com boom, the nation has seen periods of unprecedented growth and prosperity. However, in recent years, the economy has faced significant challenges, including the outsourcing of manufacturing jobs to countries with lower labor costs. But amidst these challenges, a new trend is emerging that promises to revive the American economy: the rise of new factories buying build.

The role of new factories in boosting economic growth

New factories have the potential to play a crucial role in boosting economic growth in the United States. These factories are not only creating jobs, but they are also driving innovation and technological advancement. By investing in state-of-the-art manufacturing facilities, these factories are able to produce high-quality products that can compete on a global scale.

Understanding the concept of “New Factories Buying Build”

The concept of “New Factories Buying Build” refers to the trend of new factories being established in the United States, particularly in sectors that were previously dominated by foreign suppliers. This trend is driven by several factors, including the rising cost of transportation to the USA and the shifting dynamics of global trade.

Factors driving the shift of Chinese suppliers to Mexico

One of the key factors driving the shift of Chinese suppliers to Mexico is the cost of transportation to the USA. As transportation costs continue to rise, it becomes less economically viable for Chinese suppliers to ship their products to the United States. By establishing factories in Mexico, these suppliers can significantly reduce transportation costs and improve their overall competitiveness.

Challenges and potential risks associated with the rise of new factories

While the rise of new factories buying build presents numerous opportunities for the American economy, it also comes with its fair share of challenges and potential risks. One of the main challenges is the need for skilled labor. As new factories continue to emerge, there is a growing demand for skilled workers who can operate and maintain the sophisticated machinery used in modern manufacturing. Additionally, there is a risk of overreliance on foreign suppliers, particularly if the American manufacturing sector fails to keep up with the pace of innovation.

Government initiatives and policies supporting the revival of the American economy

Recognizing the importance of new factories in reviving the American economy, the government has implemented several initiatives and policies to support this trend. These include tax incentives for companies that invest in new manufacturing facilities, funding for workforce training programs, and the promotion of research and development in key industries. By creating a favorable business environment, the government aims to attract more companies to establish new factories in the United States.

Conclusion: The future of the American economy and the role of new factories

In conclusion, the rise of new factories buying build holds great promise for the revival of the American economy. By investing in advanced manufacturing facilities and leveraging technological advancements, these factories have the potential to boost economic growth, create jobs, and drive innovation. However, it is crucial for the government and industry stakeholders to address the challenges and risks associated with this trend, such as the need for skilled labor and the potential overreliance on foreign suppliers. With the right policies and support, the future of the American economy looks bright, and new factories will play a vital role in shaping that future.

Are you looking to take advantage of the rise of new factories? World Buying Service can help with your sourcing. Contact us today to learn more.

Source Photo: www.unsplash.com

Introduction: Companies Pulling Out of China

In recent years, there has been a noticeable trend of companies pulling out of China. This shift in global business operations has garnered significant attention and raised important questions about the reasons behind it and the implications for global supply chains. In this article, we will delve into the factors driving this trend, the impact of the ongoing trade war between the United States and China, potential sanctions on China, alternatives to sourcing from China, the challenges faced when pulling out of the country, case studies of companies that have already done so, strategies for companies considering this move, and finally, the future of companies sourcing outside of China.

Reasons behind the trend

There are several reasons behind the growing number of companies that are pulling out of China. One key factor is the trade war between the United States and China. The tit-for-tat tariffs imposed by both countries have disrupted global trade and increased costs for companies operating in China. This has led many companies to reassess their manufacturing and sourcing strategies and explore alternatives.

Another reason is the potential sanctions on China. The Chinese government’s policies and practices, such as intellectual property theft and human rights violations, have raised concerns among companies and governments alike. As a result, there is an increasing push for sanctions on China, which further incentivizes companies to seek other sourcing options.

Impact of the trade war on companies

There are several reasons behind the growing number of companies that are pulling out of China. One key factor is the trade war between the United States and China. The tit-for-tat tariffs imposed by both countries have disrupted global trade and increased costs for companies operating in China. This has led many companies to reassess their manufacturing and sourcing strategies and explore alternatives.

Another reason is the potential sanctions on China. The Chinese government’s policies and practices, such as intellectual property theft and human rights violations, have raised concerns among companies and governments alike. As a result, there is an increasing push for sanctions on China, which further incentivizes companies to seek other sourcing options.

Potential sanctions on China

The potential for sanctions on China is another significant factor driving companies to pull out of the country. The Chinese government’s practices, such as forced technology transfers and intellectual property theft, have raised concerns among companies and governments worldwide. These practices not only harm individual companies but also undermine fair competition and the integrity of global trade.

In response to these concerns, there has been a growing call for sanctions on China. These sanctions could take various forms, including restrictions on trade, investment, and technology transfer. The prospect of such sanctions further motivates companies to explore alternatives to sourcing from China, as they seek to avoid potential disruptions to their supply chains and protect their intellectual property.

Alternatives to sourcing from China

As companies look for alternatives to sourcing from China, they have started to explore various options. One option is to relocate manufacturing operations to other countries in the region, such as Vietnam, Thailand, or Malaysia. These countries offer lower labor costs and favorable business environments, making them attractive alternatives to China.

Another option is to reshore manufacturing operations back to the company’s home country. This allows companies to have greater control over their supply chains and reduce their dependence on foreign suppliers. While reshoring can be more expensive initially, it offers long-term benefits such as improved quality control, faster delivery times, and reduced transportation costs.

Challenges faced when pulling out of China

While the decision to pull out of China may seem appealing, it is not without its challenges. One major challenge is the complex process of disentangling from existing supplier networks and finding new suppliers. Companies must carefully evaluate potential suppliers in terms of quality, reliability, and cost-effectiveness. This process can be time-consuming and requires significant resources.

Another challenge is the potential disruption to production and supply chains during the transition period. Companies must ensure a smooth transition to new suppliers and manufacturing locations to avoid delays and maintain customer satisfaction. Additionally, companies may face legal and regulatory hurdles in the new countries they choose to operate in, requiring careful navigation of local laws and regulations.

Implications for global supply chains

The growing trend of companies pulling out of China has significant implications for global supply chains. As more companies diversify their sourcing locations, global supply chains are becoming more complex and fragmented. This can lead to increased costs and longer lead times as companies need to manage multiple suppliers and transportation routes.

Moreover, the shift away from China could have long-term geopolitical implications. China has been a dominant player in global manufacturing and trade, and its absence could reshape the global economic landscape. Other countries may step in to fill the void left by China, leading to a redistribution of economic power and potentially altering trade dynamics.

Case studies of companies that have pulled out of China

Several companies have already made the decision to pull out of China, providing valuable case studies for others considering this move. One such company is Apple, which has been gradually diversifying its supply chain away from China. Apple has expanded its manufacturing operations in countries like India and Vietnam, reducing its reliance on China for production.

Another example is the sportswear giant Nike, which has been shifting its production to countries like Vietnam and Indonesia. Nike has recognized the benefits of diversifying its supply chain to mitigate risks and improve efficiency. These case studies highlight the challenges and opportunities involved in pulling out of China and provide valuable insights for other companies considering a similar move.

Strategies for companies considering pulling out of China

For companies considering pulling out of China, there are several strategies they can employ to navigate this transition successfully. Firstly, thorough research and due diligence are crucial. Companies should carefully evaluate potential alternative sourcing locations, considering factors such as labor costs, business environment, infrastructure, and availability of skilled workers.

Secondly, companies should develop a phased approach to minimize disruption to their operations and supply chains. This could involve gradually reducing reliance on Chinese suppliers while simultaneously building relationships with new suppliers in the desired locations. It is also important to maintain open communication with existing suppliers and provide support during the transition period.

Lastly, companies should consider diversifying their supply chain beyond a single country. By spreading their operations across multiple countries, companies can reduce their vulnerability to geopolitical risks and disruptions in any one location. This strategy allows for greater flexibility and resilience in the face of changing market conditions.

Conclusion: The future of companies sourcing outside of China

The trend of companies pulling out of China is likely to continue in the coming years, driven by a combination of factors such as the trade war, potential sanctions, and the desire to diversify supply chains. While this trend poses significant challenges, it also presents opportunities for companies to explore new markets, reduce risks, and improve efficiency.

As companies navigate this transition, careful planning, research, and strategic decision-making will be crucial. By diversifying sourcing locations, companies can enhance their resilience and adaptability in an increasingly complex and uncertain global business environment.

In conclusion, the decision to pull out of China is not one to be taken lightly. However, for companies willing to invest the time and resources, it can lead to long-term benefits and a more secure position in the global marketplace.

If you are a company considering pulling out of China or diversifying your sourcing locations, World Buying Service can help. With our extensive network of suppliers in many locations, we can connect you with reliable partners who meet your specific needs. Contact us today to explore the possibilities and make your transition a smooth and successful one.

Post Tags :

Share :

Copyright © 2023 World Buying Service INC